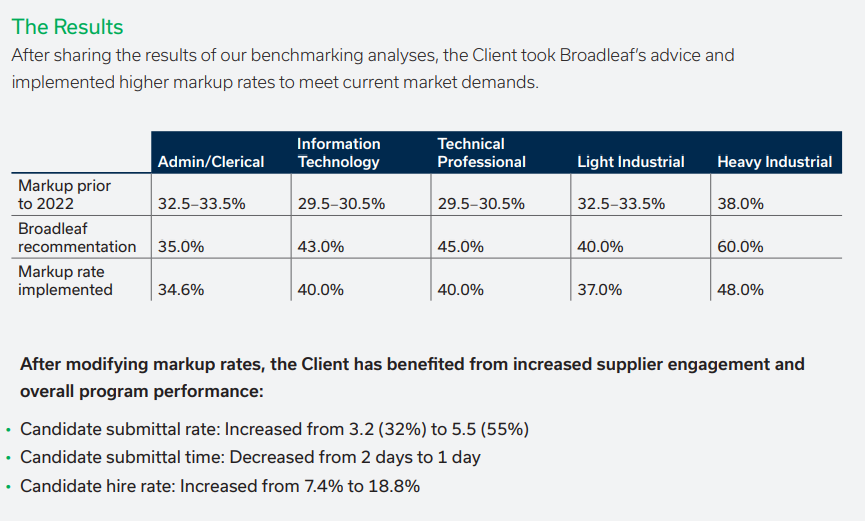

A leading provider of training and simulation solutions engaged Broadleaf to identify ways to improve supplier engagement and overall program performance to attract high-quality candidates. Our team performed rate and market benchmarking analyses tailored to our Client’s job types. To meet current market demand, the Client modified their markup rates and benefited from a decrease in candidate submittal time and an increase in candidate submittals and hire rates.

The Client

A leading provider of training and simulation solutions, our Client’s 1,500+ employees and 35+ sites across the U.S. help defense and security professionals prepare for operations and maintain mission readiness.

The Situation

After implementing a markup rate reduction in 2020, the Client experienced a steady decline in supplier participation, difficulty attracting new suppliers, changing labor market conditions, statutory burden increases, and rising inflation. Upon divesting from its parent company at the beginning of 2022, The Client looked to Broadleaf’s team for assistance with attracting top talent and increasing their time-to-fill rate.

The Challenge

To be successful, the Broadleaf team would need to overcome the following obstacles:

- The Client was now operating in a candidate-driven labor market in which jobs are abundant and top-tier candidates are scarce—resulting in a decreased candidate pool.

- Suppliers were disengaging from the MSP program and partnering with customers that paid higher markup rates.

- The volume of supplier candidate submittals was low and the time-to-fill rate was high.

- The quality of candidates presented by suppliers to the Client’s hiring managers was steadily declining.

The Solution

Broadleaf realized the Client’s immediate need to review all current rate structures and models being used within its contingent workforce population. Our team got to work—using our suite of technology platforms—performing rate and market benchmarking analyses tailored to the Client’s job types including software engineers, systems engineers, assemblers, and welders. Suppliers were asked to provide feedback regarding their experience participating in the Client’s MSP program and the challenges they were facing when filling positions.